Self Managed Super Fund (SMSF) Advice

Today more and more Australians are choosing to manage their own Superannuation through Self Managed Super Funds (SMSFs). The Rolls Royce of super funds, a SMSF is a totally customised, individual fund that can give you greater control over your superannuation monies.

SMSF’s can also be surprisingly affordable. Our experience has shown that in some circumstances they can be even cheaper than their industry fund equivalents.

Having a SMSF can allow you to implement customised strategies, including:

- Personalised investment strategies, including separate strategies for each member

- Manage your personal insurances (Death, TPD, Income Protection)

- Custom Estate Planning strategies

- Transfer business property into super (not allowed in other types of super funds)

- Borrowing to invest (in direct property or other investments)

- Manage or eliminate Capital Gains Tax

Being a member and trustee of a SMSF requires specialist knowledge and guidance, which is where Elemental Wealth Management can help.

Darren Eising has been involved with SMSF’s for more than 15 years and is an SMSF Specialist AdviserTM (SSATM), accredited through the peak body for SMSF Advisers and Auditors, the SMSF Association.

Advisers with the SMSF Specialist Adviser TM designation have undergone an independent accreditation program, which not only tests knowledge of SMSF legislation and regulatory requirements, but also assesses professional business and ethical practices to ensure ‘best practice’ standards are upheld.

SMSF Characteristics

While SMSFs are free from some regulations placed on standard Super Funds, it’s important to understand there are additional SMSF rules and restrictions that must be followed.

An SMSF has characteristics including, but not limited to:

- 1 to 4 members only.

- A Trustee of an SMSF can be either an individual or a Corporate Trustee.

- Each member of the Fund is a Trustee or is a Director of the Corporate Trustee.

- No member of the SMSF can be an employee of another, unless the members are related.

- Trustees must not receive any remuneration from the Fund.

SMSF Uses/Applications

Examples of where an SMSF may be appropriate include:

- A business owner looking to include commercial property in their Super.

- A retiree who is looking to take a more active role controlling their Retirement income.

- An individual wanting greater participation in their Super.

- A family group (maximum 4 members) looking to pool their Super Funds.

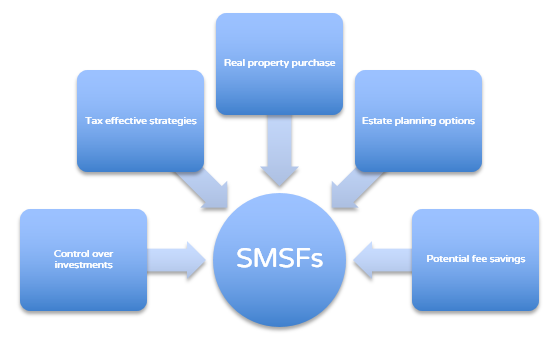

The Pros and Cons of an SMSF

The Pros and Cons of an SMSF

The Pros and Cons of a SMSF include, but are not limited to:

| Pros | Cons |

| You have more control over how and where your money is invested | You have to administer the Fund (or pay a company to do so) |

| SMSFs can purchase your business’ real property | You are required to prepare, implement and regularly review the Fund’s investment strategy, insurance requirements etc |

| SMSFs offer the potential to use tax savings strategies not possible in other types of Funds | Penalties for non-compliance range from financial penalties to imprisonment |

| Potential fee savings | You are responsible for making sure your Fund complies with regulations |