Superannuation Advice

Compulsory superannuation means that everyone has a super fund. Nearly 10% of your pay goes into this fund – so it makes sense to take an active interest in what happens with your super.

Choosing the best fund and investment plan for your circumstances is a complicated task. Our role is to match a fund to your requirements and ensure that it performs to your expectations.

Superannuation funds also offer life, disability and income protection insurance. Having this cover in your super fund can ensure that you have the protection you require, without impacting your daily budget.

Remember that the goal of your superannuation fund is to provide you with a comfortable lifestyle in retirement. A small investment of time and effort now can pay off ten-fold in the years to come. Take an active interest in what your fund is doing and how it can help you, both now and in retirement.

Timing: Starting Early Makes a Difference

Superannuation is often forgotten (the industry term here is ‘disengagement’). You can’t use the money for another 30 or 40 years, so why care what happens to it now?

Well, taking control not only means learning, it can also mean that you may not have to work as hard later (this is covered more in my post about the upcoming retirement crisis).

The earlier you make a start the better chance your super fund has to grow.

Having a longer timeframe also means you can afford to take higher risks (within reason of course). Higher risks can, but not always, lead to higher returns. Higher returns over a longer timeframe means more money in your pocket.

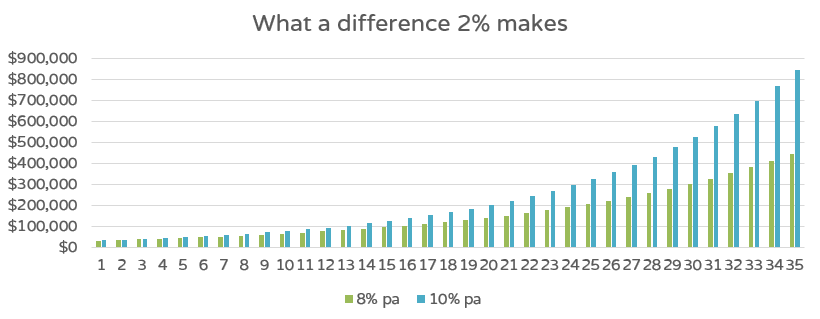

As a simple example, assume you have $30,000 in super. You are 25 years old and don’t really care about what happens with the money. Here is a graph showing the difference a return of just 2% pa more can make over 35 years:

In the early years, there doesn’t seem like much of an advantage, but as the laws of compounding kick in, things really start to move. By the end, an increase of just 2% pa can nearly DOUBLE the account balance ($840,000 versus $440,000). So what are you waiting for?

In the early years, there doesn’t seem like much of an advantage, but as the laws of compounding kick in, things really start to move. By the end, an increase of just 2% pa can nearly DOUBLE the account balance ($840,000 versus $440,000). So what are you waiting for?

Insurance: Protection is Important!

Your super fund can also do a lot more than teach you how to invest. It can also protect your assets and income via life, disability and income protection insurance. The best thing is that the premiums are paid by your fund and don’t affect your day-to-day budget. This often means someone who normally couldn’t afford comprehensive cover, will be protected.